Value creation

Nexus Infrastructure creates long-term sustainable organic growth and value for stakeholders.

Use the tabs below to find out more about how we create value

Our investment case

Essential infrastructure solutions

High-quality customer relationships and expertise

Experienced and loyal team

Robust balance sheet

Chronic undersupply of housing in the UK

Sustainability

Market opportunity

Civil engineering and infrastructure solutions to UK housebuilders and developers

Market Drivers

- Housing shortage and regeneration of urban and brownfield areas

- National Housing Federation has identified the need for up to 340,000 new homes in England per year up to 2031

- Government incentives and initiatives to accelerate housing delivery

- Expected reduction in inflation during 2024, allowing interest rates to be reduced, supporting new home sales

- Support driven by the accepted importance of the housing market to the wider economy

Opportunities

- Growth in demand for new housing developments due to the national housing shortage and the requirement for affordable housing

- Large-scale, complex, multi-phase developments requiring experienced infrastructure partners

- Non-private tenure provides more predictable delivery requirements

- Potential for additional Government funding to unlock and accelerate land acquisition for housing developments

- Demand for essential infrastructure services in other sectors

Nexus’ mission is to be recognised as the leading provider of essential infrastructure solutions in the UK, by delivering outstanding performance through a focus on delivery, customer service, and diversification.

Our strategic priorities

Growing with our customers

- Continual developments in the quality, features, and diversification of our offering

- Building and growing customer relationships, supported by high-quality service, competitive pricing, and a long-standing focus on health and safety

- Assuring and supporting customers delivering multiphase, complex projects, using our extensive experience

Expanding our market

- Track record of identifying and investing in growing sectors and building go-to-market subsidiary operations

- Highly experienced Board and Executive Team with extensive expertise across a range of infrastructure sectors

- Securing opportunities across new projects and sectors, and delivering innovative services

Focus on financial delivery

- Improving the level and consistency of operating margins

- Investing resources to improve productivity and enable growth

- Managing overheads and discretionary spend, while maintaining tight control of cash

Our business model

The resources and relationships we need to run our business:

Our people

Highly skilled, motivated and loyal workforce. Experienced senior management team and Board.

Markets

Essential market supported by national housing shortage and requirement for affordable housing.

Financials

A strong balance sheet provides resilience and sustainability.

Business development

Customer engagement

Consultation and estimating

Value engineering

Planning

Programme and logistics

Procurement and resources

Project collaboration

Execution

Flexible delivery

Team approach

Safe working

Our Shareholders

Committed to enabling a progressive dividend policy during challenging market condition periods.

Our Customers

Relationships, partnerships and effective engagement with our customers to understand their individual challenges and needs.

Our People

Group purpose and values with a strong focus on staff development and learning as well as health, safety and wellbeing.

Our Communities

Financial support to charities, staff volunteering days, supporting educational organisations and pupils, and more.

Safety and sustainability

Our fundamental goal is that everyone goes home safely at the end of every day. The health, safety and wellbeing of our people is at the forefront of everything we do, supported by safety campaigns, training and wellbeing initiatives. Taking care of our environment, while providing essential infrastructure solutions, is core to our approach.

Customer service

Our customers choose us because we are dedicated to quality delivery and take the time to fully understand their project objectives. We ensure all our teams are customer focused during the consultation, procurement, and delivery stages. As well as meeting and exceeding our customers’ needs, this means ensuring the expectations of residents and users of new homes and facilities are also satisfied.

Best solutions

Through our close relationships with our customers, we work in partnership to develop the right solutions for their development. Our teams will always challenge assumptions and wherever possible find a better way to deliver the best solutions for our customers’ projects.

KPIs

The Board uses key performance indicators to measure its progress against the Group’s strategic objectives.

- Revenue and revenue growth track our performance against our strategic aim to grow the business

| 2023: | 88.7 |

| 2022: | 98.4 |

| 2021: | 78.0 |

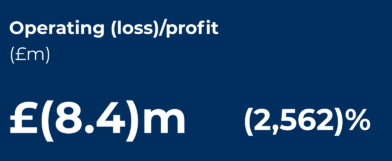

- Tracking operating profit/(loss) ensures that the focus remains on delivering profitable outcomes on our contracts

| 2023: | (8.4) |

| 2022: | (0.3) |

| 2021: | 1.3 |

- Tracking the after-tax earnings relative to the average number of shares in issue provides a monitor on shareholder value

| 2023: | 239.0 |

| 2022: | 6.0 |

| 2021: | 6.6 |

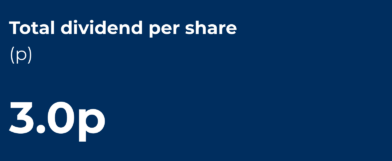

- Tracking the total dividend per share declared for each financial year provides a monitor on the return achieved for shareholders

| 2023: | 3.0 |

| 2022: | 1.0 |

| 2021: | 2.0 |

- Tracking the cash balance monitors the conversion of profits into cash, ensuring that cash is available for reinvestment or distribution to shareholders

| 2023: | 14.6 |

| 2022: | 4.6 |

| 2021: | 5.8 |

- The tracking of the order book, being the amount of secured work yet to be recorded as revenue provides visibility on expected future revenue against the strategic aim to grow the business

| 2023: | 46.0 |

| 2022: | 95.5 |

| 2021: | 85.3 |

- The tracking of the Group’s net assets monitors the Group’s financial strength and stability

| 2023: | 33.0 |

| 2022: | 34.1 |

| 2021: | 32.1 |

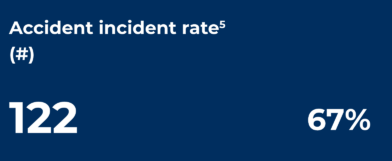

- Health and safety is of paramount importance as the Group’s businesses work in sectors which carry significant health and safety risks

| 2023: | 122 |

| 2022: | 369 |

| 2021: | 627 |

- Tracking the Group’s CO2 emissions allows us to monitor the impact of our businesses on the environment

| 2023: | 56,660 |

| 2022: | 43,370 |

| 2021: | 33,920 |

- Monitoring our loyal customer base provides insights into our repeat business, quality delivery and customer service.

| 2023: | 65 |

| 2022: | 53 |

| 2021: | 60 |

1 Excluding discontinued operations.

2 Continuing operations, including the return to shareholders on the sale of TriConnex and eSmart Networks.

3 Cash and cash equivalents less borrowings for continuing operations.

4 Secured work yet to be carried out for continuing operations.

5 All figures updated to reflect continuing operations.